For long time, the two Hong Kong and Singapore have been competing to be the best place to conduct business in Asia mostly through tax-friendly procedures, pleasant business environment and life quality.

Although Hong Kong has a longer history as a corporate centre, Singapore has quickly caught up, weakening Hong Kong's supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its grounds.

There is no simple black-and-white response to the question which jurisdiction today is more appealing to start business. It is a very competitive environment, and some investors select Singapore for lifestyle reasons or for the strength of infrastructure and service suppliers. Some select Hong Kong primarily to gain access to the larger Chinese and North Asian markets. Smaller enterprises frequently select Singapore because it offers more appealing tax incentives and a lower cost environment than its competitor.

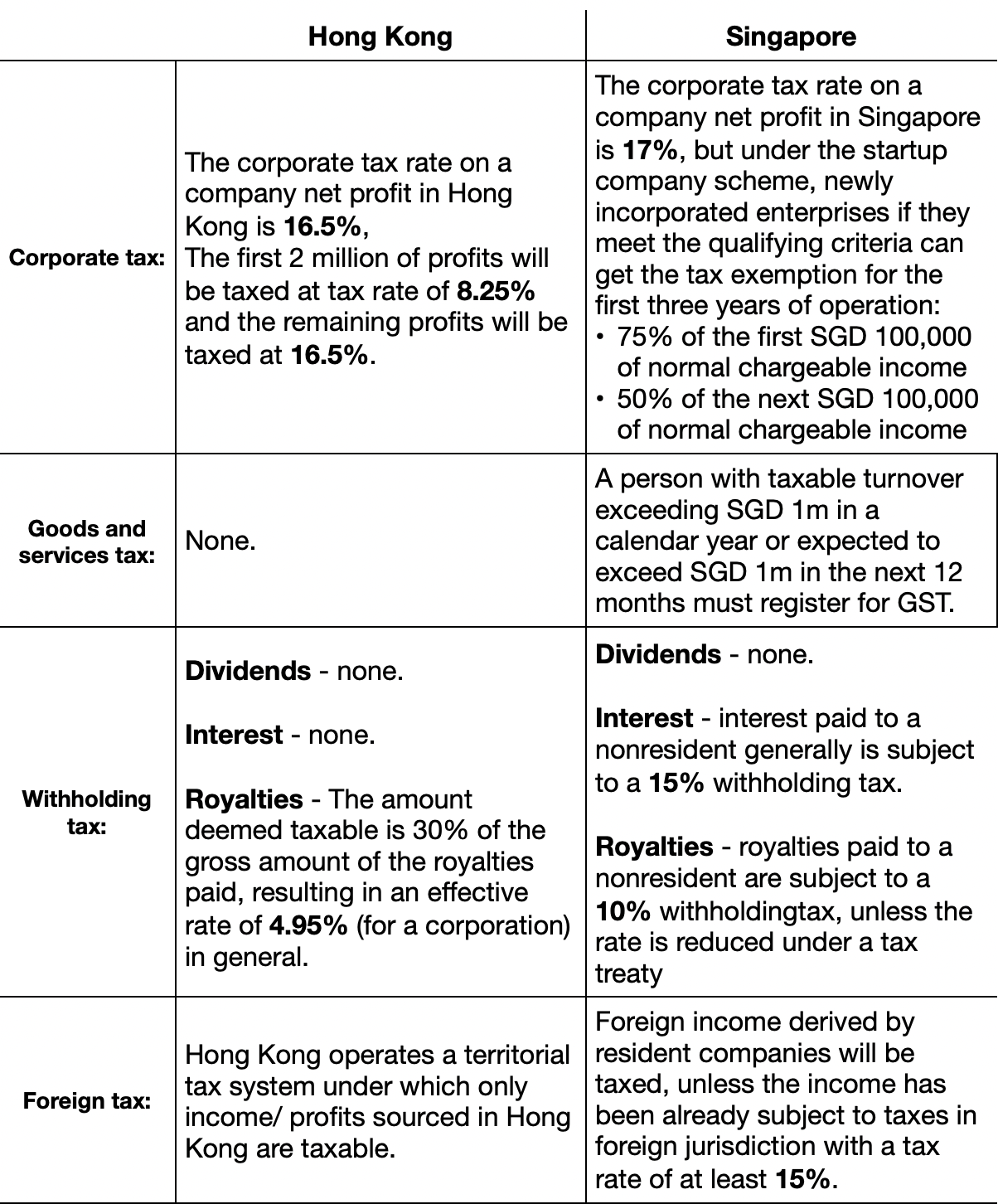

Please see the table below for a tax comparison for corporate & individual taxes of these two jurisdictions.

Corporate taxation:

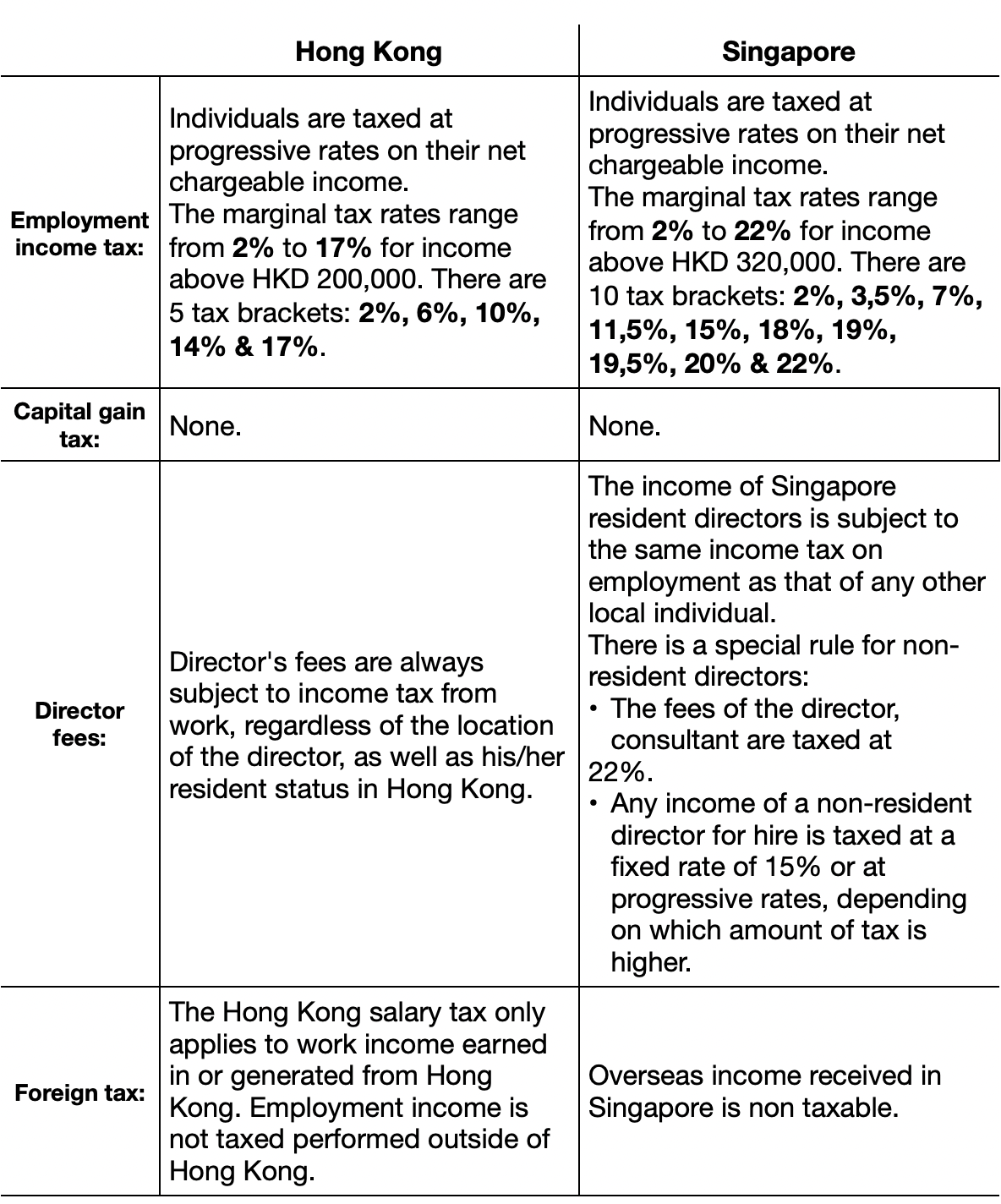

Taxation on Individuals:

Double taxation agreements:

Singapore has executed an extensive network of DTA’s or other similar tax agreement with most of the important economies of the world. Singapore now has much more possibilities than Hong Kong, which has only approved 45 complete DTAs to far. However, both nations have lately expanded the number of DTAs they have, and this trend seems to continue in the near future for both Hong Kong and Singapore.

Singapore’s Avoidance of Double Taxation Agreements:

Albania, Australia, Austria, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Brunei, Bulgaria, Cambodia, Canada, China, Cyprus, Czech Republic, Denmark, Ecuador, Egypt, Estonia, Ethiopia, Fiji, Finland, France, Georgia, Germany, Ghana, Greece, Guernsey, Hungary, India, Indonesia, Ireland, Isle of Man, Israel, Italy, Japan, Jersey, Jordan, Kazakhstan, Korea, Kuwait, Laos, Latvia, Libya, Liechtenstein, Lithuania, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Mongolia, Morocco, Myanmar, Netherlands, New Zealand, Nigeria, Norway, Oman, Pakistan, Panama, Papua New Guinea, Philippines, Poland, Portugal, Qatar,Romania, Russian Federation, Rwanda, San Marino, Saudi Arabia, Serbia, Seychelles, Slovak Republic, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Taiwan, Thailand, Tunisia, Turkey, Turkmenistan, Ukraine, United Arab Emirates, United Kingdom, Uruguay, Uzbekistan, Vietnam

Hong Kong’s Avoidance of Double Taxation Agreements:

Austria, Indonesia, New Zealand, Belarus, Ireland, Pakistan, Belgium , Italy, Portugal, Brunei , Japan , Qatar, Cambodia , Jersey, Romania, Canada, South Korea, Russia, People's Republic of China, Kuwait, Saudi Arabia, Czech Republic, Latvia, Serbia, Estonia , Liechtenstein, South Africa, Finland, Luxembourg, Spain, France, Macau, Switzerland, Georgia, Malaysia, Thailand, Guernsey, Malta, United Arab Emirates, Hungary, Mexico, United Kingdom, India, The Netherlands, Vietnam

Conclusion:

In conclusion, Singapore and Hong Kong are performing as a strong rivals for international business in the Asian region. Both Hong Kong and Singapore offer very welcoming tax and investment policies for any types of business, either it a startup or International corporation.

In the recent GLOBAL BUSINESS COMPLEXITY INDEX 2022 GUIDE from TMF, Singapore took 58th position (50th position in 2021) and Hong Kong got into top 10 least complex jurisdictions with 74th position (76th position in 2021).

Both Singapore and Hong Kong are excellent choices for business incorporation. Are you considering establishing your regional headquarters in Singapore or Hong Kong?

Shile Consulting already helped numerous businesses to incorporate in these jurisdictions.

Please get in touch with us at cn.shileconsulting@outlook.com and we will consult you on setting up a business in new regions.